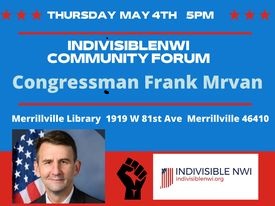

On Thursday, May 4, at 5pm at the Merrillville Library Congressman Frank Mrvan will join us for a Community Forum to discuss the Inflation Reduction Act.

This legislation, signed into law last August, features the largest climate initiatives in history, along with significant healthcare savings for everyday Americans. It also funds the IRS to provide much better customer service and technology upgrades along with tax law enforcements for wealthy Americans and corporations. This bill will save millions of Americans thousands of dollars while decreasing the deficit by billions.

Please register for this important event: https://www.mobilize.us/indivisiblenwi/event/560046/

Read below for information about this sweeping legislation and please share. Most people don’t know much or anything about what’s in this bill. Let’s spread the word!

Key Components

- The IRA includes historic investments in clean energy tax credits that will encourage the development of carbon-reducing infrastructure and move toward a 40% emissions reduction from 2005 levels by 2030.

- Credits and subsidies for technologies including renewable electricity, hydrogen, clean vehicles, carbon capture and sequestration, and nuclear power will be extended by 10 years to 2032.

- The bill will also incentivize the creation of clean energy jobs, lower energy bills by $500 to $1,000 each year, and invest in disadvantaged communities bearing the cumulative impacts of environmental injustice.

- This bill saves millions of Americans hundreds of dollars each year in health care costs

- The IRA will reduce the federal deficit.

There’s A LOT to celebrate! Because of the Inflation Reduction Act

Every household in America will benefit. Whether it’s ushering in a clean energy future, creating millions of good-paying union jobs, or keeping money in the pockets of our hard working families, the federal government is solving big problems and building a better future for generations to come. Here are the most exciting things to hype:

Accelerating Our Clean Energy Future

- Modernizing & weatherizing the electrical grid is one of the biggest projects we’re addressing with the IRA. In order to meet the energy demands of today, we have to update our electrical grid. These grid improvements will help deliver more electricity from clean energy sources and be more reliable during extreme weather events, like hurricanes, floods, and snowstorms.

- Companies are already breaking ground on new projects that will bring clean energy and jobs to communities across the country — solar & wind projects, battery factories (aka gigafactories) for things like electric cars, and electric vehicle (EVs) manufacturing plants.

- The Clean Energy Plan will help the U.S. gain energy independence. By generating our own renewable and reliable energy here in the U.S., we will stabilize the energy market and increase affordability.

Creating Millions of Jobs

- Our communities will benefit from ~9 million jobs being created over the next 10 years. That’s just about 1 million good-paying, family-supporting jobs per year! (BlueGreen Alliance)

- Since it was signed into law in August 2022, the Inflation Reduction Act is already creating 142,000 jobs thanks to 191 new clean energy projects in 41 states! (ClimatePower.us)

- These jobs are being created across the country and are for everyone. Whether you live in a suburban, rural, or metropolitan area, have a college degree or not, there’s a job (and training) for all kinds of job seekers.

Keeping Money In Our Pockets

- Homeowners can take advantage of discounts to reduce costs of making their homes more energy efficient. This includes things like rooftop solar, energy efficient home appliances, and more!

- Lower prescription drug prices for seniors.

- Every single person who gets their insulin through Medicare will see lower monthly costs, thanks to the $35 cap on monthly insulin costs. This means 1.5 million people will save hundreds of dollars each year on this life saving drug. . (Dept. of Health & Human Services) BONUS: Our government’s leadership in capping prescription prices is leading the private sector to follow suit, also lowering insulin prices to save millions more.

- Seniors on Medicare will save money on certain drugs! Thanks to the IRA’s inflation rebate program, Medicare beneficiaries are already seeing lower coinsurance for almost 10% of prescription drugs offered through Medicare Part D whose prices rose faster than inflation. This not only puts money back in seniors’ pockets, it also discourages drug makers from excessively raising their prices. (WhiteHouse.gov)

- Health plans will continue to be more affordable for more Americans. The IRA will save about 13 million people an average of $800 per year on their health premiums thanks to the extension of tax credits for Affordable Care Act health plans. AND by making health plans more affordable, millions more people will be able to get coverage. (WhiteHouse.gov)

- [Specifically in Indiana] the Act will cap prescription drug costs for hundreds of thousands of Indiana Medicare beneficiaries, reduce health insurance premiums for tens of thousands of Hoosiers by about $870 per year on average while expanding coverage to about 33,000 Hoosiers, and cap insulin co-payments for the tens of thousands of Indiana Medicare beneficiaries that use insulin.” Vaccines for Medicare recipients will be free.

(whitehouse.gov state fact sheet: https://www.whitehouse.gov/wp-content/uploads/2022/08/Indiana-Health-Care.pdf Read important details at that site also.

| On Top of It All, It Pays for Itself! Here are some truths about the Inflation Reduction Act: The Inflation Reduction Act is more than fully paid for — in fact, it will reduce the deficit by $300 billion. The IRA does NOT raise taxes on anyone making less than $400,000 a year, or on small businesses. Thanks to the minimum corporate tax rate being set at 15%, big corporations are finally going to be paying what they owe! Billion-dollar corporations will no longer get a free ride off of average Americans like our nurses, firefighters, and teachers. The tax revenue from this change is part of what covers the cost of the IRA! Right now, the richest 1% avoid paying $160 billion a year that they owe in taxes because the IRS lacks enough tax enforcement staff. The IRA strengthens enforcement to crack down on this tax cheating by the wealthy and corporations, so our communities get the money we need for our healthcare, schools, and roads. |

For homeowners: Interactive house map; click on each area to learn what your tax savings and rebates could be:

https://www.whitehouse.gov/cleanenergy/

Use this calculator from Rewiring America to see how much money you can get from the Inflation Reduction Act: https://www.rewiringamerica.org/app/ira-calculator

We’ve already seen the benefits of the IRS funding during this past tax season. The IRS provided live assistance to 87% of taxpayers’ phone calls during the 2023 tax filing season, up from 15%. Call waiting times were down to four minutes from 27 minutes. (Reuters:

https://www.reuters.com/world/us/us-irs-answered-24-million-more-taxpayer-calls-due-new-funding-2023-04-17/)

To download and print this document: handout-overview-from Indivisible